For its Insurer of the Month series, Assurances Multi-Risques spoke with Carol Jardine, President of Canadian Operations at Wawanesa Insurance, a mutual insurance company owned by its policyholders. It is one of Canada’s largest property and casualty insurance companies.

Since 2018, Wawanesa insurance products have been distributed by independent insurance brokers across Canada. In Quebec,

In a recent press release issued by Wawanesa, you stated the following:

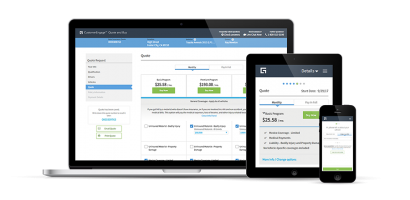

Wawanesa Mutual Insurance Company has partnered with Capgemini to offer two industry-leading digital solutions: Guidewire InsuranceSuite™ and BluePass. These digital platforms will help Wawanesa and all Ontario insurance brokers deliver exceptional customer service to all current and future insurance policyholders in the province.

(Wawanesa, october 29 2019)

Have these new digital platforms yielded good results so far?

We are very pleased with the results, as are brokers in other provinces. Transactions that used to take up to a day to process can now be completed in minutes, which means our team of experienced underwriters can now spend more time helping brokers and their clients navigate complex situations.

Over the past few years, we have invested close to $300 million in new digital technologies that enable independent insurance brokers to better serve a clientele whose demand for services and coverage is constantly growing.

This new system is set to be launched in Quebec in 2020…

What changes can Quebec customers expect? What improvements will this new system bring?

Quebec will be the last province to have access to the Insurance Suite and Bluepass systems, and it is also where the changes brought about by these systems will be most noticeable, as our products will now be offered exclusively through insurance brokers. We will therefore be consigning our old mainframe computer and the WIS system to the dustbin of history. Customers will receive policy documents with a fresh new look and billing documents that are easier to read. Brokers will be able to communicate with other Wawanesa brokers across the country, who are already raving about how easy our BluePass portal is to use.

Once the new system is in place, we will continue to invest in and improve the delivery of digital services to all brokers across the country, in both English and French. We want our systems to enable brokers to advise their clients quickly and efficiently, while offering them attractive risk management and pricing options. Eliminating sources of friction related to transactions so that brokers can focus on client relationships is exactly what modern systems should offer!

Wawanesa now offers its products through a network of brokers.

What factors motivated this choice? What do you see as the advantages of this approach? Are the results conclusive?

Consumer research tells us that consumers value independent advice when purchasing complex financial products such as insurance coverage. Wawanesa products are now offered exclusively through brokers in Quebec and the rest of Canada because we believe that brokers are best positioned to understand and respond to consumers’ specific needs.

In terms of results, sales in Quebec over the past few months are on track to exceed what we were seeing immediately prior to switching to insurance brokerage services. This tells us that this business decision was likely the right one and that people do indeed appreciate dealing with brokers.

In Canada, brokers appreciate that a company of our size, which recorded nearly $3 billion in sales in 2019, is committed to entrusting them with all of its business. For our part, we believe that the support we provide to brokers is central to our success. We are proud to be the largest national property and casualty insurance company represented exclusively by brokers, particularly here in Quebec.

What are Wawanesa’s mutualist values and how are they reflected in its social commitments?

The Wawanesa Mutual Property and Casualty Insurance Company was founded 123 years ago in the small farming community of Wawanesa, Manitoba. At that time, 20 farmers got together to solve a common problem. Their wooden grain threshing equipment was at high risk of being lost in a fire, and the insurers of the day were charging them too much to insure these essential assets. So they each invested $20 to set up their own mutual insurance company, thereby securing both insurance coverage and ownership of a business.

These farmers chose to look after each other by spreading the risk, ensuring that no one would be left behind if problems arose.

Our company and our values stem from the decision made by these 20 farmers 123 years ago. They are as follows:

Service – We strive to provide exceptional customer service by demonstrating empathy.

Transparency – We conduct our business with integrity and take pride in doing so.

Impartiality – Regardless of the circumstances, we treat everyone impartially.

Collaboration – We are one team and we respect everyone’s opinion.

Community – Community support is at the core of our identity.

Our commitment to giving back to the communities where we live and work is central to our mutualist values. That’s why we’ve partnered with several Canadian charities that serve the communities where our company operates. We also make donations to a large number of colleges and universities across the country.

In Quebec, we are currently in the midst of our holiday toy drive in collaboration with the Quebec Major Junior Hockey League (QMJHL), various local charities, and a number of independent insurance brokers. The goal of this campaign is to collect new toys and donations that will be distributed to children in need across the province during the holiday season.